By Mike Cook

Since the onset of Covid-19, “That a large segment of our Hispanic population, 30 percent, had difficulty paying their bills should give us pause,” Las Cruces Mayor Pro Tempore Kasandra Gandara said during a Jan. 13 virtual news conference about the results of a December 2021 survey conducted to determine how Hispanic families in New Mexico are doing economically during the pandemic.

Gandara and others participating in the news conference urged New Mexico legislators to use part of the state’s budget surplus and federal American Rescue Plan Act funds “to assist the most vulnerable of the population.” The Legislature is meeting in a 30-day budget session that continues through Feb. 17.

During the news conference, Gabriel Sanchez, Ph.D., released the results of the survey, conducted by BSP Research.

“This survey makes clear that while many Latino families across the state have been able to leverage government resources to help them get back on their feet during one of the most challenging periods in state history, there are many households in New Mexico that continue to struggle,” Sanchez said in an email to the Bulletin.

The survey, conducted in English and Spanish Dec. 8-29, via landline, cellphone and online with 1,000 Hispanic adults in New Mexico, was commissioned by the New Mexico Economic Relief Working Group (ERWG) which is comprised of Somos Un Pueblo Unido, El CENTRO de Igualdad y Derechos, Comunidades de Fe en Acción (CAFé) of Las Cruces, New Mexico Voices for Children and the Partnership for Community Action.

The survey “has an oversample of immigrants to ensure that the views of all Latinos across the state are represented,” according to the survey report. It has a margin of error of plus-or-minus 3.1 percent, Sanchez said.

In addition to Gandara and Sanchez, others participating in the news conference were Santa Fe County Commissioner Anna Hansen, Albuquerque City Council President Isaac Benton and Mirna Lazcano, an El CENTRO member whose family impacted by the pandemic. The moderator was Marcela Diaz of Somos un Pueblo Unido.

Sanchez is vice president of research and lead researcher for BSP Research and works in Albuquerque. He is the Founding Robert Wood Johnson Foundation Endowed Chair in Health Policy at the University of New Mexico and director of the UNM Center for Social Policy.

BPS does public-opinion polling, message and ad testing, data analytics and modeling and qualitative research.

Visit https://bspresearch.com/.

Survey findings

- 28 percent of respondents reported themselves or someone in their household having Covid-19. 24 percent had a family member or friend die due to Covid. “New Mexico Department of Health data suggests Latinos in New Mexico have suffered higher hospitalization and casualty rates (due to Covid) than non-Hispanic whites,” the survey said, and “Hispanics are twice as likely to be hospitalized than whites.”

- In response to this question, “During the past year due to the coronavirus pandemic, did you or anyone in your household experience any of the following?” 30 percent had difficulty paying bills or utilities; 26 percent spent all of their savings or went into debt; 24 percent had their work hours cut or a pay cut but kept their jobs; 23 percent had difficulty paying rent or a mortgage; 19 percent lost their jobs; 19 percent skipped doctors’ appointments or didn’t seek medical care; and 13 percent reported not having enough food to eat and skipping meals.

- More responses to the question above: 20 percent of rural respondents and 6 percent of urban respondents said they had to work when they or a family member was sick because of a lack of paid sick leave; 14 percent of rural respondents and 6 percent of urban respondents said their childcare arrangements were disrupted; 16 percent of rural respondents and 9 percent of urban respondents said the business they owned shut down or had a drop in revenue; 15 percent of rural respondents and 8 percent of urban respondents said they were at risk of losing housing due to a foreclosure or eviction; and 10 percent of rural respondents and 6 percent of urban respondents said they lost health insurance.

- Among those surveyed, women were more likely than men to have: 1) difficulties paying their bills or utilities (plus 8 percent); more likely to have lost a job (plus 5 percent); 2) spent all their savings or have gone into debt (plus 5 percent); and 3) skipped a doctor’s appointment (plus 9 percent).

- In response to this question, “Have you done any of the following to manage your financial situation during the pandemic?” 34 percent said they have cut back on buying basic household goods or necessities; 32 percent used all or most of their savings to pay family expenses; 28 percent borrowed money from friends or family; 24 percent skipped a monthly car, rent, utility or mortgage payment; 21 percent put off medical appointments; 19 percent borrowed money from a payday or easy loan company with a high interest rate; 16 percent applied for a loan from a bank or credit union; 14 percent moved or changed their housing situation; and 9 percent stopped going to school to cut education or career-related expenses.

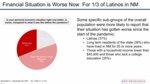

- 60 percent of survey respondents said they had $1,000 or less in savings for financial emergencies and 35 percent had $100 or less.

- 28 percent reported making less than $20,000 before taxes in 2020.

- In response this question, “How did you use the economic relief or cash assistance you received from the federal or state government?” 68 percent said the money was used to pay basic living expenses; 34 percent said it paid overdue bills, including rent or mortgage payments; 21 percent said it was used to pay back friends or relatives from whom money had been borrowed; 19 percent said it was used to pay off or pay down creditors; 19 percent said it was used to buy a vehicle or pay for vehicle repairs; and 15 percent said they money allowed them to have a medical procedure they had put off.

- 32 percent of respondents said they received a stimulus check; 33 percent said they received SNAP, EBT and/or WIC benefits; 16 percent said they received no pandemic-related government benefits; 25 percent said they received Medicaid/ Children's Health Insurance Program payments; 15 percent said they received unemployment insurance; 16 percent said they received a federal child tax credit; 11 percent said they received cash assistance from the city, county or state government; 11 percent said they received TANF cash assistance; 11 percent said they received state tax credits for low-income/working families; 8 percent said they received help paying for childcare; 6 percent said they received a small business or PPP loan; 10 percent said they received rental/mortgage assistance from local or state government. (Most percentages were smaller among the survey’s Spanish speakers.)

- 38 percent of respondents said helping New Mexicans struggling financially due to the pandemic is the issue they most want to see the governor and state Legislature address. 28 percent listed affordable housing in answer to the question; 26 percent said keeping people safe from the pandemic; 22 percent said the rising cost of living; and 19 percent said creating jobs with better wages.

- In response to this question, “How important is it to you that all hard-working New Mexicans, including undocumented immigrants, have access to the same government resources as everyone else?” 58 percent said it was very important, 30 percent said it somewhat important, 7 percent said it was not that important and 5 percent said it was not important at all.

“This survey makes clear that while many Latino families across the state have been able to leverage government resources to help them get back on their feet during one of the most challenging periods in state history, there are many households in New Mexico that continue to struggle,” Sanchez said.